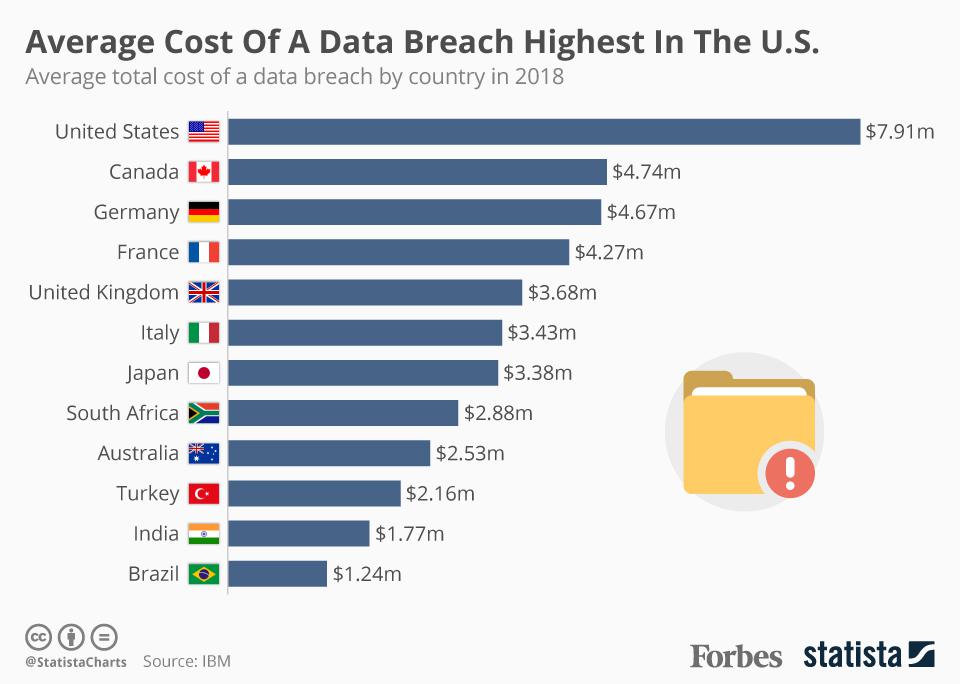

And for small businesses, the financial impact might be more than you think. In all, 90 percent of breaches impact small businesses, and the average cost of a data breach for a small business is $36,000. For many smaller companies, that amount can hurt. A lot.

But there’s an important reason it costs so much; you must protect yourself and your customers after a breach.

Why Does a Data Breach Cost So Much?

A data breach causes a chain reaction of events that can drive up the cost of managing an incident. Anything from forensic analysis of a business’ payment system to mandatory reporting requirements can cost a pretty penny.

Most states mandate several steps that may require professional assistance from an outside vendor. That could include notification of customers, credit monitoring for affected customers, and reassessment for PCI ( Payment Card Industry) compliance. All of that adds up.

And those are just the monetary costs. A data breach can cause other damages that can indirectly hurt your business’ bank account. According to a recent study on breach notification by the Ponemon Institute, 57 percent of people who received a breach notification from a business said they lost trust and confidence in the organization. 31 percent of those surveyed by the institute said they ended their relationship with the company where the breach occurred.

Other factors that could hurt revenue due to a data breach include negative press surrounding the incident, loss of payment card privileges, and a loss of time spent doing damage control rather than growing your business.

About 50 percent of U.S. companies fail in their first five years – five out of ten. And while estimates for the number of small businesses that close due to a data breach are murkier, some studies have placed that figure as high as 60 percent.

Avoid the Costs of a Breach

Updating credit card terminals with the new EMV chip card readers help secure customer data for brick-and-mortar transactions. But that alone won’t protect your online presence from a potential hack. Protecting your online business transactions is more complex and a constantly changing landscape of threats.

IT moves quickly, and so do cybercriminals, who increasingly target merchants’ point-of-sale systems that process electronic payments. That means your business doesn’t even have to store cardholder data to be at risk for a data breach.

Today’s cyber attacks have become very sophisticated, and data thieves have found many points where information passing through a business’ system could be stolen. That’s why your company’s cyber security systems and protocols must be constantly monitored, updated, and managed to keep ahead of the threats.

Hiring a proven IT firm to manage your business’ technology and data can go a long way to shoring up your cyber security capabilities. A professional company with IT security experts can help a small business manage and maintain its secure information technology – and, by extension, its sensitive data.

A multi-layered approach to guarding against cyber theft is the best way to ensure your data’s safety and maintain your customers’ confidence. Protect yourself today.